Oakleaf has continued to invest heavily in our US business this year with the addition of 3 new members to the consulting team.

“I am delighted to share that Stefan Schneider, Tina Slocum and Carter Hoekstra have all the joined the New York office and Faye Tracey has returned from maternity leave to launch our West Coast practice from San Francisco.”

Simon Hunt

Managing Director – US

Stefan Schneider - New York

Stefan has joined the team to transact in the executive HR space and help us scale and build the Oakleaf business here in the US with his outstanding experience in the HR profession. He has an extensive following across the Tri-State region and we look forward to the support he can bring to the business. Stefan will be focusing across industry with particular focus in the consumer sector and across senior HR operations, reward, analytics and payroll for all non-financial services & professional services sectors.

Tina Slocum - New York

Tina joins us from another boutique HR recruitment business where she was rapidly building a fantastic reputation. Her calm, consultative approach aligns so well to the HR community. She will partner with Max Horton, delivering key HR hires to the healthcare, life sciences & industrial sectors predominantly and brings further sector specialism to the team.

Faye Tracey - San Francisco

Faye has a blend of agency search and in house experience. She first joined Oakleaf in London in 2016 before relocating to the Bay area in 2018 with another international recruitment business. She spent 5 years there, eventually leading their HR practice on the West Coast before rejoining Oakleaf. We are delighted to have her back in the business. She brings a wealth of HR recruitment expertise to the team. She will concentrate on West Coast customers and the tech, media, and telecom from a sector standpoint.

Carter Hoekstra - New York

Carter joins us from a boutique HR recruitment firm on the West Coast where he delivered top quality service to customers in the Bay area. Carter will join forces with Stefan to build out Oakleaf’s presence in the consumer world and he has already been servicing some fantastic brands in this space, especially where customers need great talent in hard to source locations.

Market Intelligence

The first six months of 2024 has been a period of two halves. January through March, we saw some improvement in hiring numbers. Then in the second quarter of the year, we saw some stagnation in activity. The third quarter of the year has since seen opportunities improve significantly with job flow up and much more noise around hiring and talent planning.

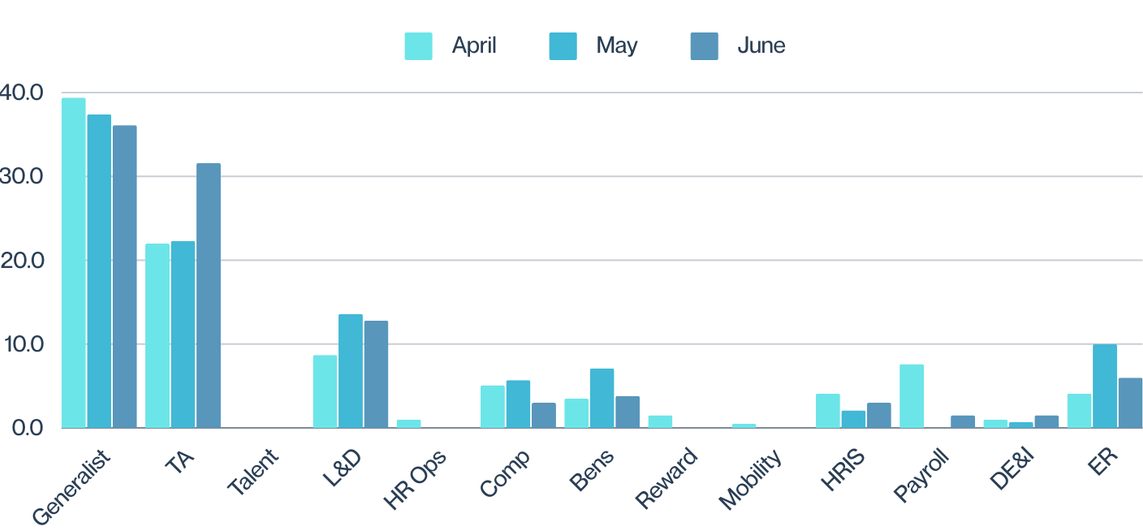

Direct Company Vacancies Q4 ‘23 – Q2 ‘24**

** Percentages of advertised vacancy type across HR

A glance back to July 2023 continues to show a positive comparison. Roles in talent acquisition and employee relations are up significantly year-on-year, by 62% and 47% respectively. Demand was higher comparatively this July in the L&D (+29%), benefits (+11%) and generalist (10%) spaces than a year ago. Roles in DE&I and compensation remained identical across July 2023 and July 2024.

Industry Insights

Professional Services

HR roles in the professions have been relatively stable +/- 7% for over 12 months now. There has been consistent hiring across the HR function. The tail end of 2023 saw an influx in hiring across talent development – professional development and business support. This continued into early ‘24 and seems to be now tailing off. Many organizations have been reviewing their HR operations functions, and we continue to see much activity in this area. The challenge for hiring is that most firms HR operations functions are structured differently or are responsible for different pillars of the HR function. There has also been a considerable amount of shift in the CPO/ Head of HR US seat with several organizations making changes. Some have chosen to attract talent from outside of the sector too, which is a positive move.

Financial Services

HR and total rewards roles in financial services have gone up 14% since the start of the year and interestingly they have seen growth of 56% in the last year. This was probably the most surprising metric we noted. Most of these hires have been at the more junior level across HR teams; more operational hiring than strategic hiring. Teams have been building up with talent at junior business partner level, junior learning or talent and then over the last 6 months there has been much more activity across compensation, benefits and HRIS up to the VP level. CPO/CHRO hires have been low in volume and it remains challenging for senior leaders looking for opportunities. We have noticed an increase in portfolio operations teams hiring or changing up their TA/talent partners which could infer upskilling ahead of an increase in activity from investors. Much of the 56% is outside of the traditional financial services business areas and is more aligned to fintech and start-up environments.

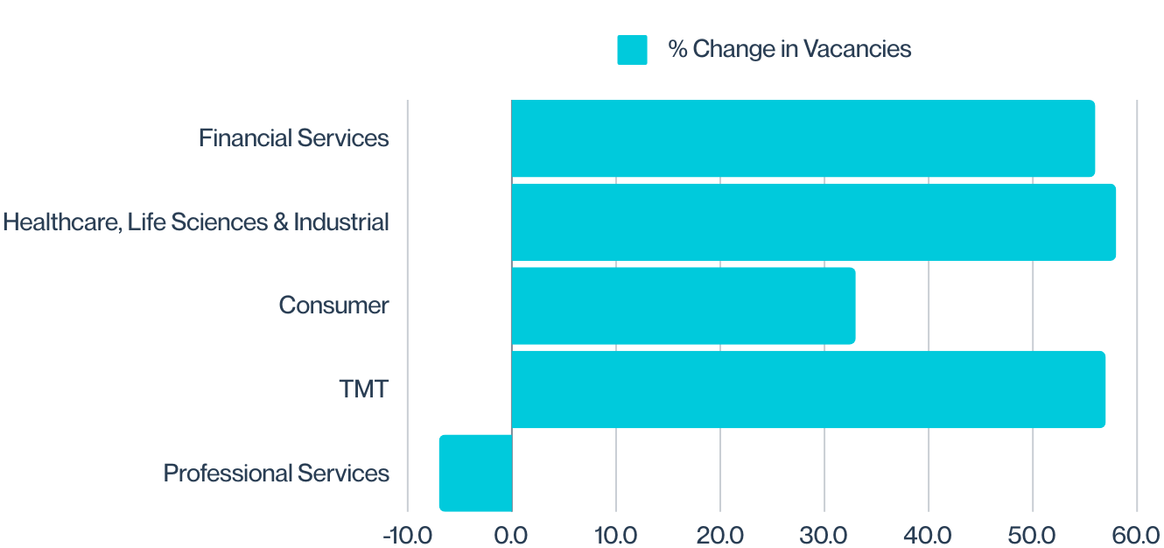

Commercial Markets

While broader industry sectors have enjoyed an overall growth in hires of 14%, a deeper dive reveals significant increases up through July for HR and total reward professionals in life sciences and supply chain/logistics markets (+58%) and technology, media and telecom firms (+57%). Demand in the consumer market across retail, hospitality and leisure businesses rose by 33% over the same period.

Industry July 23 v July 24

Looking back at a year-on-year comparisons shows considerable growth in roles across all industry sectors which is heartwarming! Numbers across industry were 39% higher compared to July 2023.

Technology, media and telecom has been a sector undergoing change. The recent waves of hiring and then downsizing seem to have stabilized for now. Some major global organizations have been going through significant business transformation programs and as such, HR has needed to support this process as much as determine their own operating models dependent on the outcomes. HR hiring volumes in the TMT sectors reflect the rapid evolution and growth of these industries, with a strong emphasis on managing talent in a competitive and ever-changing environment. Tech remains the front runner for evolving firms needing HR talent. Across 125 Series A and B investments in H1 of ‘24, AI-related companies represented 40% of the mix.

The Consumer sector has seen a real emphasis on enhancing employee experience. Companies are increasingly investing in HR roles that focus on creating inclusive environments and improving workplace culture. HR professionals with skills in data analytics, employee experience design, and change management who can navigate ongoing market fluctuations and workforce expectations are also in demand. We have also seen firms struggling to upskill talent in regional locations where they may have production or distribution facilities.

The increase in roles in Life Sciences & Healthcare has been driven by ongoing advancements in medical technology, increased focus on personalized medicine, and the expansion of healthcare services. This growth has led to a steady increase in HR hiring to support new projects, research initiatives, and expanding clinical operations. Healthcare and biotech continues to be a market with huge investment; 25% of firms with Series A & B funding in H1 of ‘24 are in this sector. M&A and IPO activity in biotech has gone up this year after a volatile 2023. This increased optimism is driving HR hiring with a particular focus on growth orientated business and HR partnering roles supporting commercial functions.

In summary, while the market for HR recruitment is improving, it is still not back to the consistency we saw in the pre pandemic years. Key points are:

- The majority of roles are being sourced directly as in house teams are still, for the most part, able to cope with the volume.

- Cost control seems to be the primary driver.

- The candidate supply is good.

- The best talent generally remains very passive.

- Time to fill remains slow, which can be frustrating to candidates and impact on employer brand.

We hope this optimism continues as we move past the US presidential election. We anticipate that we will continue to see further improvements in hiring volumes across the HR profession, given the greater certainty that it will create in the market.